Is Every Student Loan About to Be "Forgiven"? Probably Not. And That’s the Problem.

If the government can alter contracts without consequence, the damage isn’t just to borrowers—it’s to the foundation of law itself.

There’s a strange silence hanging over the federal student loan system right now.

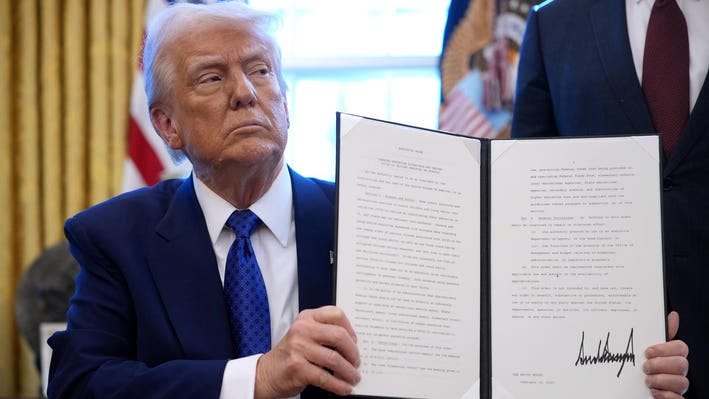

It’s not about the lawsuits. Not about the forgiveness plan that died on the steps of the Supreme Court. It’s about what’s happening after all that—quietly, under new leadership, without press conferences.

If you have a student loan, odds are your contract—the Master Promissory Note—was signed with the Department of Education.

That department doesn’t exist as it did when that contract was made. The system has been reassigned, repackaged, and politically maneuvered out of public view. In effect, a completely different agency now owns the contract you signed.

That’s not just a bureaucratic reshuffle. It’s a legal breach.

The courts aren’t likely to do anything about it.

It’s not just about student loans but potentially about every federal program and obligation.

And that’s where the collapse begins.

(This post continues for paid subscribers: an in-depth legal breakdown, case law, institutional analysis, and why student loans are just the first domino to fall.)