The Great American Fire Sale: Tonight's Joint Session Speech

How to Rob a Country: Trump, Musk, & the Economic Crash They Are Manufacturing

John Cleese is a remarkably talented and funny fellow.

Who doesn’t love the guy?

I know I do.

I mean I could not help but think of Basil Fawlty when Trump wanted to build his wall and have Mexico pay for it:

Hello?... Ah, yes Mr O'Reilly, well it's perfectly simple. When I asked you to build me a wall I was rather hoping that instead of just dumping the bricks in a pile you might have found time to cement them together... you know, one on top of another, in the traditional fashion.

The phone conversations in Fawlty Towers were comedic gems. It was a simpler time, to be sure… when the worst we had to worry about was, oh, say, nuclear war with the Soviets versus having Soviets in the White House itself.

At any rate, Cleese asked this question, I suspect somewhat tongue-in-cheek, but it begs a broader thought:

I realize you can’t read the whole embedded post, but his observation ends with the question: “Or was it just good business?”

Now I replied and said, I thought it had to do more with dictatorship than business. I’ve come to reconsider that position.

Cleese and many observers have a fundamental set of questions: What’s wrong with Trump? And Musk? And both of them? Are they trying to crash everything intentionally? Are they Soviet agents? Are they trying to ruin the economy? Are they economically illiterate? Do they believe their nonsense?

I think I have an answer: Something more sinister may be afoot.

Yes, they are intentionally going to crash the economy. Why? Because it’s how Donald Trump gets out of “jail,” with his actual constituents: the billionaire class.

And I think tonight, during the Join Session of Congress, is essentially the “Go code,” for the countdown to the implosion. While everyone else is going to be listening for outrage, and “Oh my God! Trump said women suck! Trump hates cripples! Trump said Mexicans are rapists!”

Everything he signals to those paying attention will be simple: “Get ready, billionaires and rich buddies who supported me. Operation Crash America is about to begin.”

Let me explain.

An Economic Recession Is All But Assured Now

The President is like a four-year-old banging on a car engine with a gigantic mechanic’s wrench while it runs regarding these tariffs and the other things being done via the budget, the federal bureaucracy, and the welfare state. It won’t immediately stop the engine, but as the President pours oil into the gas tank, bangs on the belts with the wrench, clogs the fuel injectors, and cuts the spark plug wires, eventually that engine is going to foul up to the point it slows down and misfires. Eventually, it could stop altogether (a massive crash.)

We’re heading for that moment.

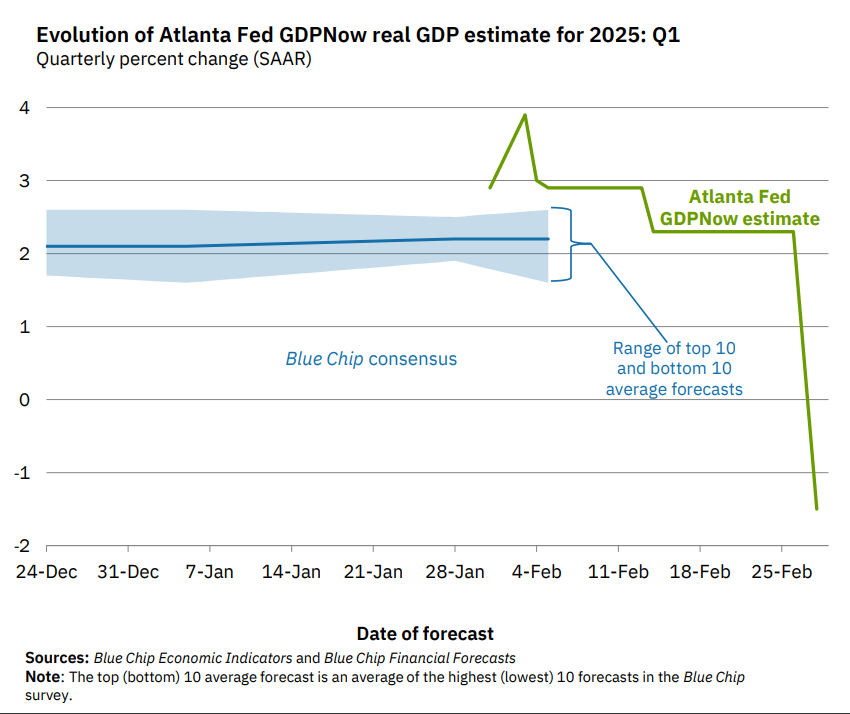

Every week, the Atlanta Federal Reserve issues a modeling product called GDPNow. This is a real-time economic model that estimates U.S. GDP growth for the current quarter based on incoming economic data.

Unlike traditional forecasts, which incorporate subjective adjustments, GDPNow is purely data-driven, updating automatically as new reports on consumer spending, investment, trade, and other key indicators are released. While it doesn't serve as an official Federal Reserve forecast, it provides a transparent and frequently updated snapshot of economic momentum, often influencing market expectations. In short, what this model gives us is a snapshot look at what the economy is likely doing in terms of growth.

When Donald Trump was elected, the forecast took a hit. Growth was revised downward from 3% GDP growth to roughly 2.1%. That may not sound like a big deal, but to put that in some perspective, that would equate to a roughly 189 billion dollars decline in the GDP. That’s more than the Departments of State, Justice, DHS, and the Federal Courts have combined as their yearly budget. Or perhaps to make it a little easier to relate to, that’s equal to the combined revenues of Aldi (the grocery chain) and ByteDance (the owners of TikTok). That’s a big drop.

After Trump was inaugurated, things went into a bubble that suddenly popped. As the chart shows, for a period of time, there was some optimism about growth, with the GDP now showing growth that is as high as 4% annually. This was back when analysts believed that Trump was using his election rhetoric as just that, rhetoric, not national policy. This view was bolstered by robust job and revenue numbers from the Q4 of 2024.

Then the delusion popped the bubble. By the middle of February, things went to hell in a handcart. The GDPNow showed the consensus prediction dropping to roughly 2, then 1, then -1.8%. All of that happened over three weeks.

To give you a sense of what that would equate to in dollar terms, that’s the equivalent of vaporizing roughly the entire budget of the US Department of Defense in THREE WEEKS, or about 840 billion dollars in GDP.

Yeah.

Then, the hits just keep on coming:

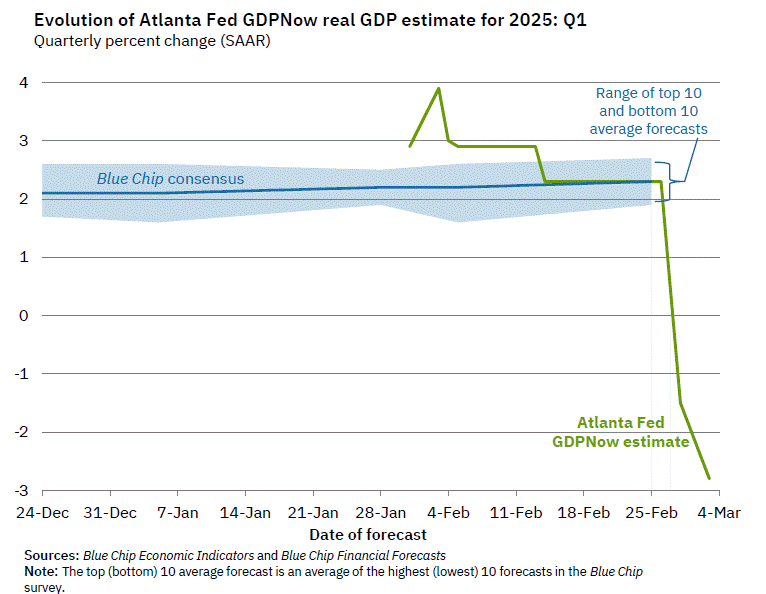

Now the consensus estimate is -2.8%.

That means we shaved another $273 billion (roughly) off our GDP from last week to this week. Again, to put that in perspective, that’s the equivalent revenues of State Farm (insurance), ByteDance (TikTok), and Bosch (the people who make electronics, sparkplugs, tools, etc.), combined (roughly).

Why?

Well, it’s pretty simple. I just want to say one word to you. Just one word.

Are you listening?

Tariffs.

That’s what is going on.

Why?

How Tariffs Screw Up the U.S. Economy

Tariffs are often sold to protect domestic industries, create jobs, and correct “unfair” trade practices. In reality, they function more like a hidden tax on consumers and businesses, distorting markets, reducing efficiency, and ultimately slowing economic growth. (For a complete treatment on who pays, see TLM’s previous article: The Gulf of Stupidity.)

Let’s break down why tariffs don’t work as their proponents claim—and how they are actively wrecking the U.S. economy.

Tariffs = A Tax on Consumers Not Countries

When the government imposes a tariff on imported goods, foreign manufacturers don’t simply absorb the cost. Instead, they pass the cost on to American companies and consumers through higher prices.

For example, if the U.S. slaps a 25% tariff on steel imports, U.S. companies that rely on steel—automakers, appliance manufacturers, construction firms—suddenly have to pay more for raw materials. Do they absorb that cost? No. They raise prices on their products, making cars, refrigerators, and homes more expensive for the average American.

So, who pays the tariff? You do.

Trump and his allies pretend tariffs only hurt foreign companies, but in reality, tariffs function like a backdoor tax on American consumers.

Retaliation: Other Countries Hit Back

Tariffs don’t exist in a vacuum. The second the U.S. imposes tariffs, other countries retaliate by slapping their tariffs on American goods.

When Trump imposed tariffs on China, China responded with tariffs on U.S. agriculture—devastating soybean farmers, pork producers, and wheat exporters.

When Biden tried to keep Trump-era steel tariffs, the EU retaliated, threatening tariffs on American whiskey and motorcycles.

Every time the U.S. plays this game, it turns into an economic arms race, where everyone loses—especially U.S. businesses that depend on exports.

Tariffs Crush U.S. Manufacturers

One of the dumbest parts of tariff policy is that it hurts the very industries it’s supposed to protect.

Example: Trump’s steel tariffs.

The goal? Protect American steel manufacturers.

The result? U.S. steel prices soared, making American-made products less competitive.

Automakers, appliance makers, and construction companies had to pay more, leading to job losses in those sectors.

By trying to help one industry, tariffs crushed multiple others. That’s because modern supply chains are interconnected—and most U.S. manufacturers rely on global suppliers for raw materials.

When tariffs increase costs, companies have three choices:

Pass the cost to consumers (higher prices, inflation).

Absorb the cost (cut jobs, lower wages).

Move production elsewhere (offshoring jobs).

None of these options help the American worker.

Tariffs Fuel Inflation

The Federal Reserve has fought inflation for years, raising interest rates to cool down price increases.

Guess what tariffs do? They do the opposite—driving prices up.

The 2018–2019 Trump tariffs increased U.S. price levels by about 0.3%—which may not sound like much, but when compounded with other inflationary pressures (oil, housing, labor costs), it’s a huge problem.

If steel, aluminum, semiconductors, and consumer goods all cost more due to tariffs, businesses raise prices to cover those costs.

This forces the Federal Reserve to increase interest rates even more to fight inflation—slowing down the economy even further.

So, not only are tariffs a hidden tax, but they also contribute to the inflationary spiral—which makes everyone’s life worse.

The Economy Becomes Less Competitive

Tariffs encourage inefficiency.

When American companies are protected from foreign competition, they have less incentive to innovate or cut costs. Instead of making better, cheaper products, they raise prices because there’s no competition forcing them to stay efficient.

The result?

Higher prices for consumers.

Lower global competitiveness for U.S. businesses.

Worse economic outcomes in the long run.

This is exactly what happened when Trump imposed tariffs on solar panels. U.S. companies didn’t ramp up production—they just kept prices higher while global competitors invested in better tech. The U.S. lost ground in a growing industry because of tariffs.

Trump’s Tariffs Directly Wrecked the Economy Before

This isn’t just theoretical. Trump already tried this, and it failed spectacularly.

His trade war with China cost U.S. farmers over $10 billion in lost exports, requiring a massive government bailout.

The U.S. manufacturing sector fell into a recession in 2019—before COVID even hit—due to tariffs raising material costs.

Job losses in industries that use imported goods (like auto and machinery) wiped out any job gains in protected sectors.

Now, he’s doing it again—but this time, the economy is already weak.

The Bottom Line: Tariffs Are a Scam

Tariffs are not a “tough” trade policy—they are a failed economic strategy that hurts workers, raises prices, slows growth, and makes U.S. industries less competitive.

And Trump knows this.

Which raises the real question: Why is he doing it again?

Well, I’ve got an answer for that, too.

Trump & Musk want to crash the economy on Purpose

You may be thinking, WHAT?

Yeah, I know. I sound like a complete fuckin nutjob. I’m totally aware of it.

That said, “hear” (read) me out and then decide.

Assuming that Donald Trump and Elon Musk are economic illiterates, their actions might seem like reckless mismanagement—an inability to understand basic cause and effect. But if you assume they’re not (assuming that this is rational and not irrational behavior), you have to ask yourself why people would want the economy to crash? In other words:

Cui Bono? (Who benefits?)

When you answer that question, you reach an inescapable conclusion: Trump and Musk know exactly what they’re doing.

They aren’t accidentally steering the economy into the ditch. They’re doing it on purpose—because a crashed economy is a once-in-a-generation wealth transfer opportunity for billionaires like them.

If you think this is incompetence, you're wrong. This is a playbook. And if you don’t understand it, you’re the mark.

Keep reading with a 7-day free trial

Subscribe to The Long Memo (TLM) to keep reading this post and get 7 days of free access to the full post archives.